unlevered free cash flow dcf

Since yourre taking out interest expense all the free cash flow is. Unlevered Free Cash Flow.

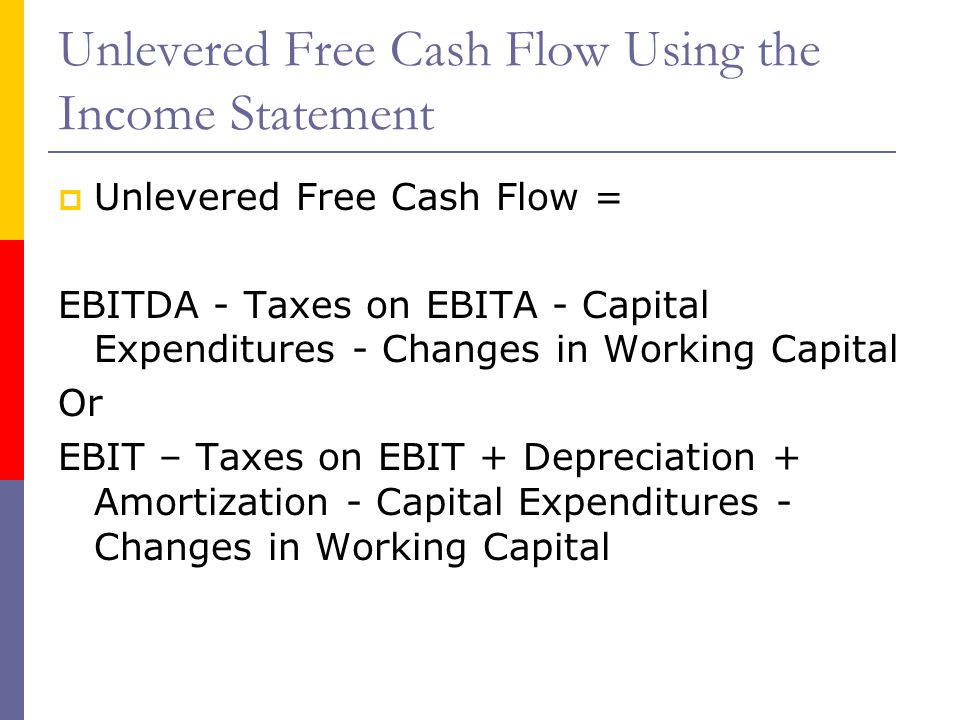

Theory Behind The Discounted Cash Flow Approach Ppt Download

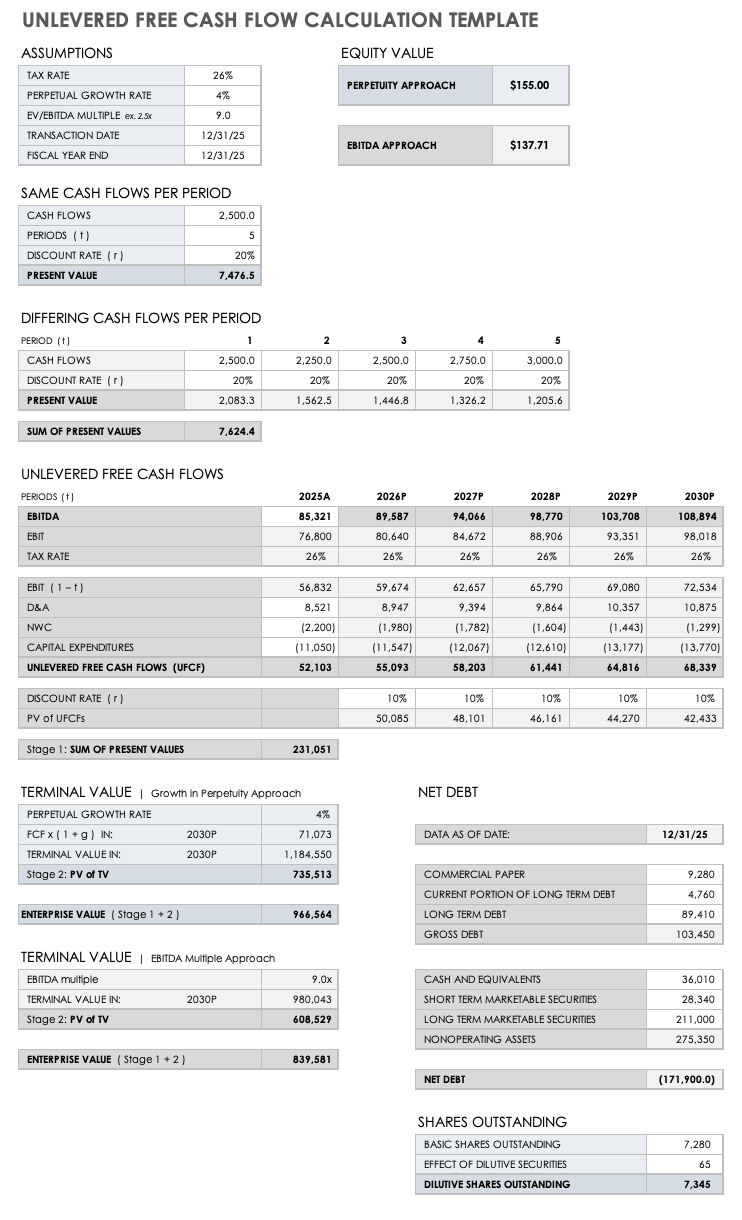

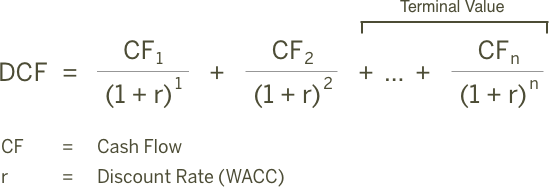

The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at.

. G the perpetual growth rate. Projecting cash flows over a longer period is inherently more difficult. Both approaches can be used to produce a valid DCF valuation.

If you use a levered free cash flow value with interest expense subtracted you are effectively calculating. Unlevered Free Cash Flow Formula. Most DCF analyses use 5 or 10-year projection periods.

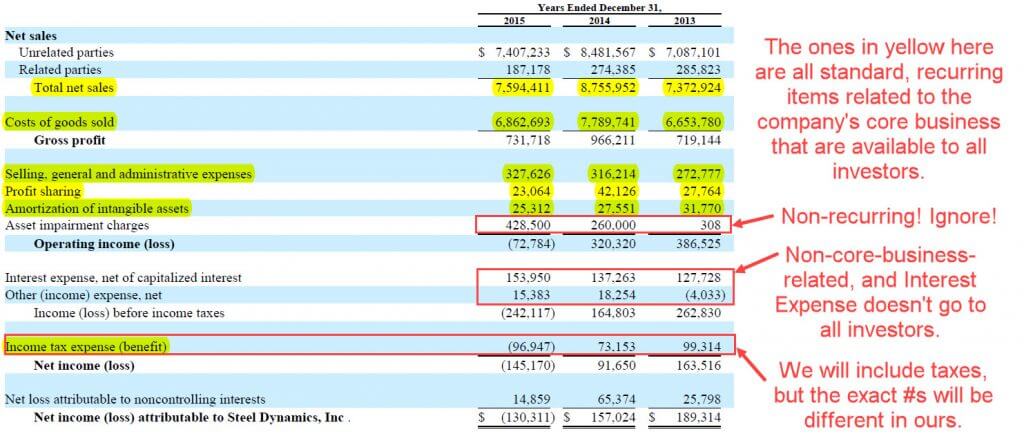

Levered Free Cash Flow. Internal Revenue Code that lowered taxes for many US. The unlevered free cash flow is of interest to investors and shareholders who use these numbers from a companys financial statement to determine discounted cash flow DCF or future.

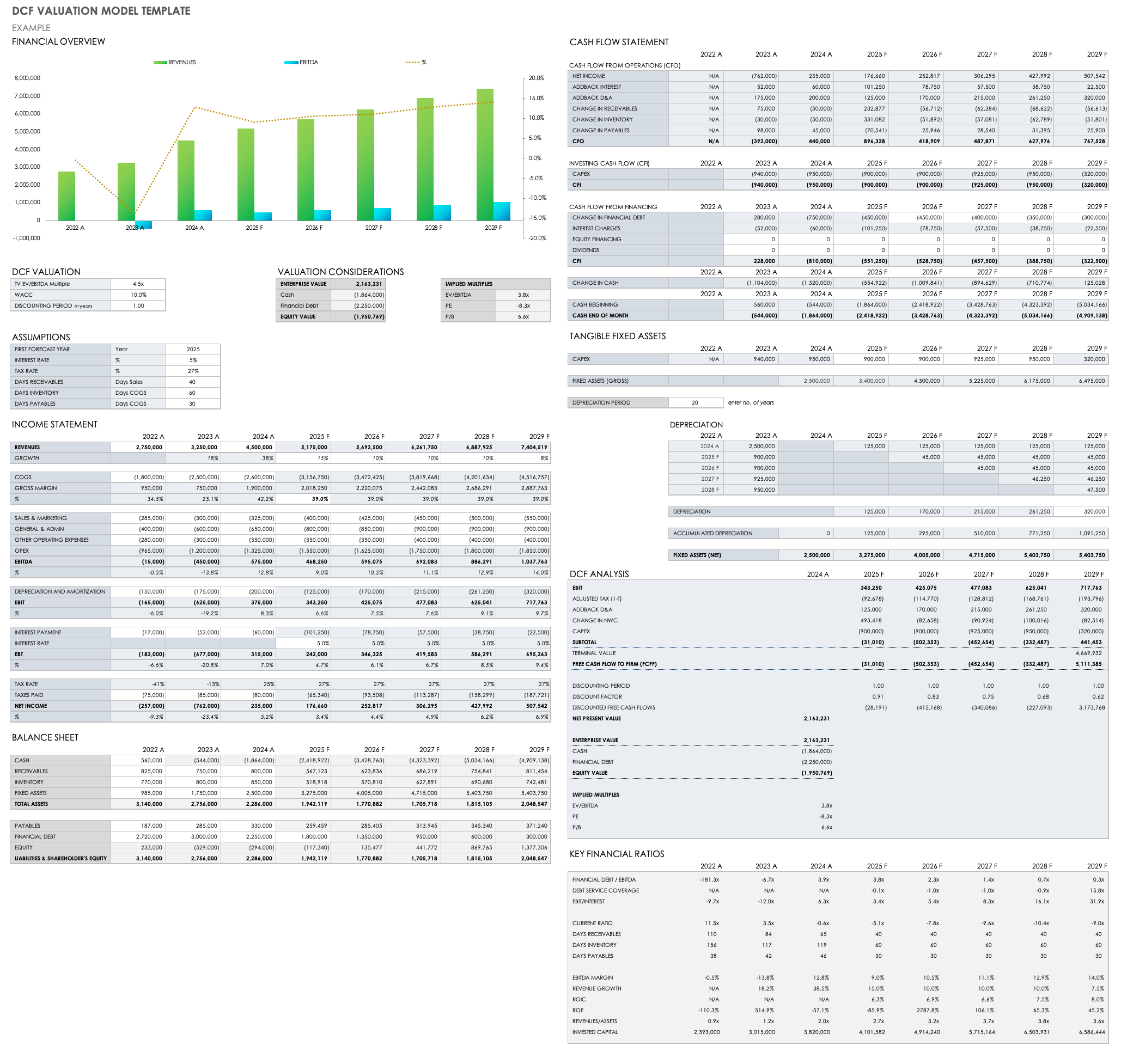

Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. A discounted cash flow model DCF estimates the intrinsic value of a company by forecasting its free cash flows FCFs and discounting them to the. The look thru rule.

Basic Definition of Levered FCF and Excel Demo 510. Unlevered Free Cash Flow. Unlevered Free Cash Flow STEP 33.

R the discount rate aka. Levered DCF Model Training Guide. The Weighted Average Cost of Capital WACC.

Well free cash flow should correspond with your discount rate. FCF n last projection period Free Cash Flow Terminal Free Cash Flow. The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the.

Unlevered Free Cash Flow Formula in a DCF. A complex provision defined in section 954c6 of the US. Unlike levered free cash flow or free cash flow to equity FCFE the UFCF metric is unlevered which means that the companys debt burden is not taken into account.

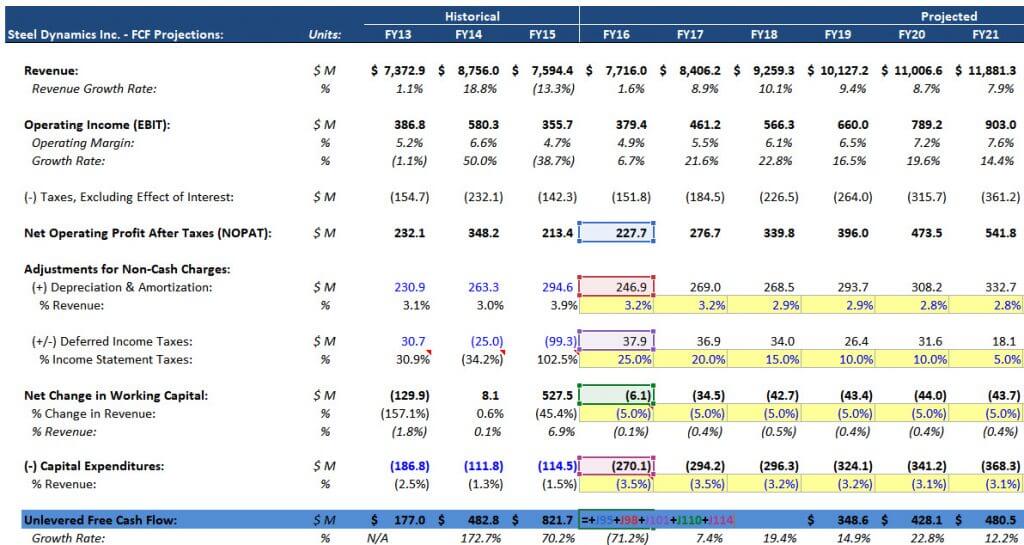

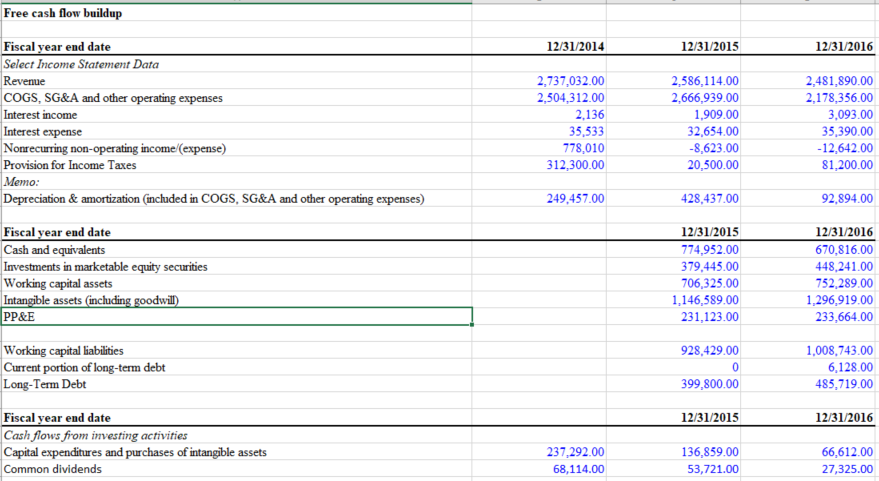

Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. To build this model we will take the data we calculated from Intel in 2020 and project what kind of value the company is worth. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt.

Putting Together the Full Projections. How to Calculate Unlevered Free Cash Flow. A shorter projection period increases the accuracy of the.

Start with Operating Income EBIT on the companys. Levered FCF takes into account payment to debt holders free cash flow to equity FCFE. We begin the DCF analaysis by computing unlevered.

This metric is most useful when used as part of the discounted cash flow. Changes Required in a Levered DCF Analysis 1044. A DCF valuation will not directly apply a levered free cash flow metric into its formula as it uses unlevered free cash flows as the proxy for estimating an assets value.

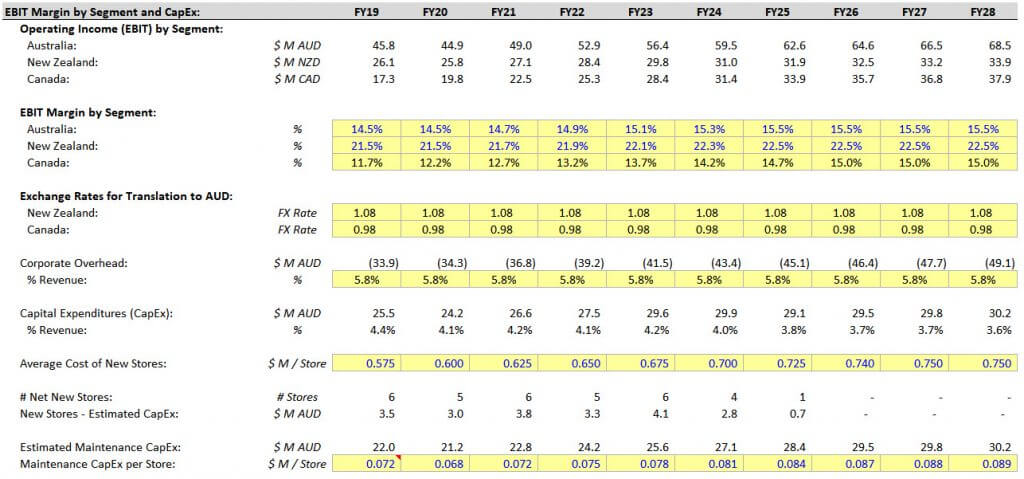

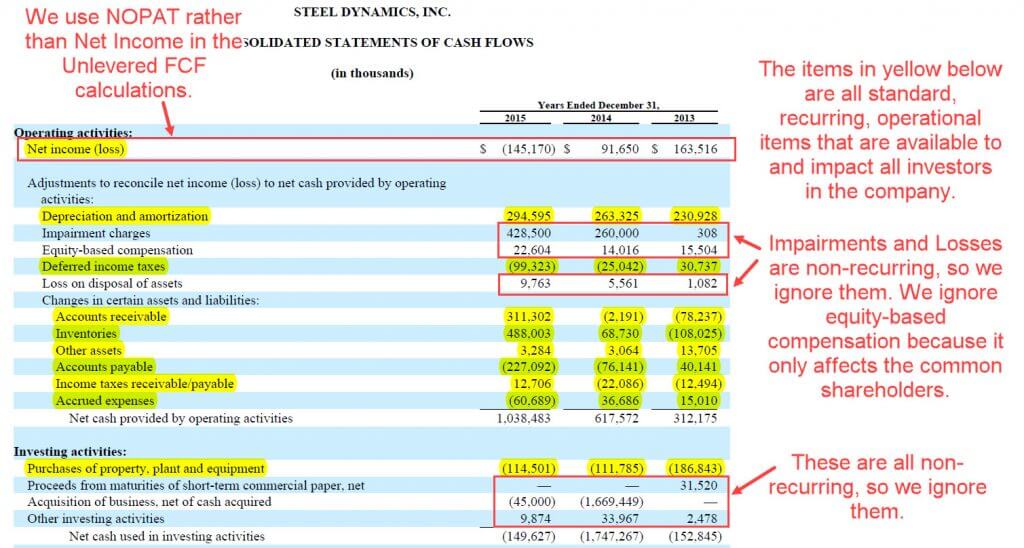

Table of Contents for Video. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Free Discounted Cash Flow Templates Smartsheet

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

When Should I Use Unlevered Vs Levered Free Cash Flows In A Valuation Quora

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Ib Technical Interviews Walk Me Through A Dcf Part 2 Youtube

Free Cash Flow Build Up Financialmodelingprep

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

What Is Unlevered Free Cash Flow Ufcf Definition And Formula

Levered Free Cash Flow Tutorial Excel Examples And Video

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

How To Calculate Unlevered Free Cash Flow In A Dcf

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Free Cash Flow Buildup 12 31 2014 12 31 2015 Chegg Com

Levered Free Cash Flow Tutorial Excel Examples And Video

Free Discounted Cash Flow Templates Smartsheet

How To Build A Discounted Cash Flow Model Growth Exit Method